3 questions to remove your blind spots while chasing adjacent markets

Original Publish Date: April 27, 2021

What’s the easiest way to grow when your core business saturates?

The range of answers you get any time you pose this question will depend on the functional expertise of the person you’re talking to. It won’t be long before someone’s eager to conclude that expanding into adjacent markets is the right answer. This should be the point where you interject with the sage advice to ‘hold their horses’.

What’s so difficult about breaking into an adjacent market?

“Only one in four adjacency initiatives are successful” – Bain & Company

Many companies make the mistake of undervaluing the effort behind entering an adjacent market. Just because it’s something close to what you currently do doesn’t mean that you’re going to dominate that market. Plus, think about companies that have spent years or decades grinding it out in your adjacent market. Can you tussle with them confidently from day one?

The pressure to improve utilization of your plants or find alternate ways to boost your flat sales or any other popular reason of the season shouldn’t be the only driving force behind your adjacent market entry.

Here’s my proposal…

At a minimum, do a simple, bare-bones due diligence before rushing into your adjacent market. Think of it as a gut-check even when you feel rushed. There are 3 questions you want to consider when you sit in front of a long list of adjacent markets and find it hard to narrow them down. Or when you feel eager to go after every single one of those markets.

CONTEXT: DO YOU REALLY WANT TO PLAY IN IT?

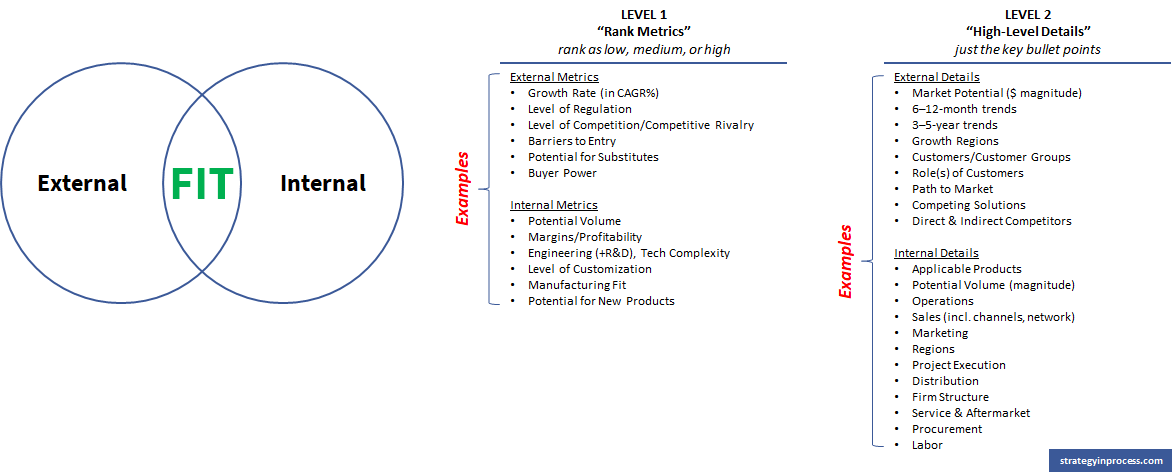

Imagine a long list of adjacent markets that are equally enterprising at first glance. Also consider the numerous evangelists behind each one of those markets telling you why it’s a ‘no miss, easy win’ decision. This is the point where you want to look at a short checklist to consider the external (‘adjacent market’) and internal (‘your business’) fit.

To add to our example, let’s say you have a list of 10-15 potential adjacent markets. How do you compare them?

Start by coming up with your own list of “rank metrics” (level 1) for the market of interest and your own business. These metrics don’t have to give you exact numbers but indicate the general health of the market and the feasibility of your business to accept a new market. To come up with rank metrics for the internal fit, ask yourself, what are the ways a perfect adjacent market will be beneficial for my business? The image above shows a few sample metrics to give you a feel. Pick your own unique metrics that speak to your situation.

Once you go through level 1; it’s very likely your long list of enterprising markets narrows down quite a bit.

If the list of adjacent markets is still long; only then do you jump into your “high-level details” (level 2). You can customize this again as you see fit. The image above shows a range of options you can consider. The key here is to keep it at a high level and meet the ‘minimum viable version’ of your due diligence compared to none.

HYPOTHESES: WHAT UNIQUE MIX OF NEW VALUE DO YOU OFFER?

This is the stage where you dive deeper into the unique competencies that your business supposedly offers in the shorter list of adjacent markets. The moment of truth.

Get together the evangelists behind each one of the remaining adjacent markets. Have them share the unique value your business will bring to the table in the adjacent market better than the incumbents. Everything they utter is likely a “hypothesis” if it’s not backed by some customer validation.

A simpler version of market validation can serve as the gut check in this stage.

A couple of years ago; I compiled a list of 5 simple steps to reduce the time in validation through effective hypothesis testing that can come in handy here. Go through this exercise for each adjacent market.

Define your ‘desired’ customer

Identify the pain points relevant to the chosen customer

Align features of your solution (what you’re offering) directly with the pain points

Think through the assumptions behind your customer, pain, solution

Craft (5 to 15) questions to prove/disprove assumptions

Finally, check if your hypotheses hold up by asking these questions to at least 10-12 different customers in the adjacent market of interest. These customers will also serve as your business development list (or champions within their companies) assuming your hypotheses are on target.

Don’t feel shy to call off the entry into a market if your unique value doesn’t exist!

PRIORITY: HOW CAN YOU ‘CRUSH’ IT FROM THE GET-GO?

A big incentive for companies wanting to enter adjacent markets is to capture fresh revenue streams in a relatively short amount of time with minimal changes to the status quo.

To that end, really prioritize the big bang for the buck pain points you want to tackle. Choose the iteration of the minimum viable product (MVP) that speaks to these pain points well. Shawn Carolan (Menlo Ventures) extends this minimum viable product concept to also account for built-in growth and rapid time-to-value. According to him, a successful MVP should also (i) have growth priced into it by generating more value over the lifetime of a customer relationship than the cost of acquiring them and (ii) prove its value faster to retain customers.

Keep working on your iterations till you find the version of MVP that fits your adjacent market fine.

All the hallmarks of a smart product launch still apply here like phasing out your rollout plan, thinking in timelines, investing in chunks as you get new market responses.

Finally, build a lean team that doubles down on the adjacent market of interest to deliver on the MVP as effectively as possible. Who knows, you might just be able to expand your offerings in this market if you play your cards right!

Entering an adjacent market is more than a simple transfer of competencies. The sooner you accept this, the faster you find the right adjacent market that values what you offer.